variable life insurance face amount

This does not include additional amounts that the policy may provide. Thus with either death or endowment the insurance company.

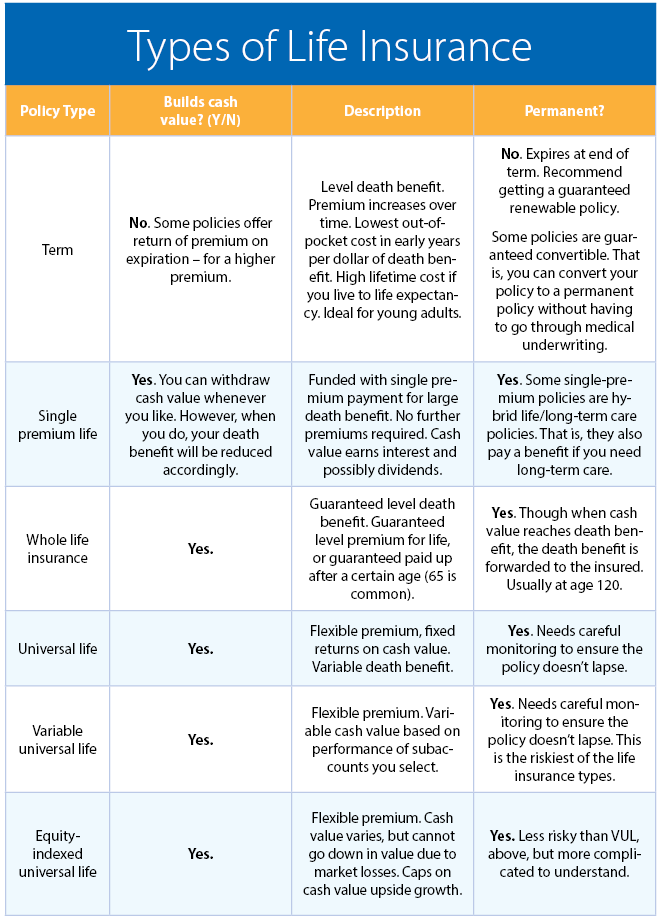

Understanding Life Insurance What Policy Type Is Best For You

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term.

. Fidelity Life stands out for offering life insurance specifically geared towards people over 60 with term life whole life guaranteed issue plans and final expense insurance. Both an insurance and securities product. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

The premium shall be determined for the total risk being insured under the policy and the premium shall be apportioned between or among the different companies on a pro rata basis commensurate with the amount of risk insured by each title insurance company as specified in the Co-Insurance Endorsement T-48. Level term period varies but often can be 5 10 15 20 or 30 years. Yes if a whole life policy reaches maturity the policyholder receives the face amount of the policy or the amount of the death benefit and the policy ends.

We explore Primerica life insurance customer satisfaction riders and more to help you find the best life insurance company for your needs. Variable life insurance. The insurance coverage you may need changes as your life changes for example getting married starting a family or buying a home may change the type or amount of coverage you need.

It provides coverage for a set number of years paying out as long as your policy hasnt expired and youve paid the premiums. You could decrease the face amount with an adjustable life insurance policy to accurately cover your needs and. Universal Life Insurance.

It is intended to meet certain insurance needs investment goals and tax planning objectives. There are other types of life insurance where the concept of the Face amount is more complex. The Nationwide Group Retirement Series includes unregistered group fixed and variable annuities issued by Nationwide Life Insurance Company.

You can get up to a 150000 term policy lasting 10 to 30 years if youre under 70. Type of life insurance Policy length Cash value Premiums Death benefit. Variable universal life insurance often shortened to VUL is a type of life insurance that builds a cash value.

Pros and Cons of Universal Life Adjustable Premiums. Term life insurance is generally more affordable than permanent life insurance. Nationwide Life Insurance Company Nationwide Life and Annuity Company Nationwide Investment Services Corporation and Nationwide Fund Distributors are separate but affiliated companies.

If the face amount of the policy is 1000000 your death benefit would be the following depending on which option you selected. Level annual renewable. Primericas increasing benefit rider allows those under the age of 56 to increase the face amount of.

Variable Whole Life Insurance can be described as A. Both an insurance and securities product B. A securities product only D.

You can also pay premiums by using the policys cash value. Insuredinsured life Insurability refers to how likely an applicant is to be offered coverage based on current health medical background family history and other factors. Maximum and minimum premiums are set but you can pay any amount between these.

Premiums can be level or vary depending on the policy. An insurance product only C. When is the face amount paid under a Joint Life and Survivor policy.

The insurance company assumes the investment risk. The Amount of Insurance stated in. Study with Quizlet and memorize flashcards containing terms like The correct answer is Provide funds to help pay taxes.

When policy reaches. Guaranteed Acceptance Life Insurance. Each insurer chooses its own indexes but common options include the Nasdaq-100 and Russell 2000.

Universal life insurance permanent Variable life insurance permanent Final expense life insurance permanent Term life insurance. In the case of whole life insurance the Face amount is the initial death benefit that can fluctuate for numerous contractual reasons. A whole life policy essentially has two values.

An indexed account is similar to variable life insurance in that you can choose to invest the cash value in different subaccounts. The named beneficiary receives the proceeds and is thereby safeguarded from the. A variable life insurance policy is a contract between you and an insurance company.

Survivorship life insurance policies are useful in estate planning because they can provide money to pay taxes on assets survivorship life policy Under a multiple protective policy the policy that pays on the death of the last person is called a. Final Expense Life Insurance. One of the most attractive features of universal life insurance is the ability to choose when and how much premium you pay as long as payments meet the minimum amount required to keep the policy active and the IRS life insurance guidelines on the maximum amount of excess premium payments you can.

The face value or death benefit and the cash value that acts as a savings account. Many people are surprised to learn that they may not have enough life insurance to cover the many expenses their loved ones could face. It is now worth 150000.

If you already had an AIG policy with a 250000 face value you could only qualify for AU processing if you apply for a new policy with a death benefit of 750000 or less. Life insurance is a protection against financial loss that would result from the premature death of an insured. Once the money invested increases the amount of the death.

The average Face amount of life insurance for calendar year 2017 was 163000. Grows based upon performance of the market though theres a guaranteed minimum annual return. With a typical whole life policy the death benefit is limited to the face amount specified in the policy and at endowment age the face amount is all that is paid out.

Face amount The face amount of the policy is the amount of the death benefit as stated in the policy.

Top 10 Pros And Cons Of Variable Universal Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

The Risks Of Cash Value Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

Life Insurance Policy Loans Tax Rules And Risks

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

Annuity Vs Life Insurance Similar Contracts Different Goals

The Risks Of Cash Value Life Insurance

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

What You Need To Know About Universal Life Insurance Pros And Cons

Is Variable Universal Life Insurance Worth It The Motley Fool

Life Insurance Loans A Risky Way To Bank On Yourself

What Are Paid Up Additions Pua In Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)